Income Verification for Gig Economy Workers

Secure and real-time income validation tailored to freelancers, contractors, and gig professionals.

Overview

In today’s dynamic economy, a growing segment of the workforce earns income from multiple gig platforms—such as ride-sharing, delivery apps, freelance portals, or consulting gigs. Traditional income verification processes fail to capture this complexity, leading to delays or outright rejections in financial services like loans, mortgages, or account approvals.

This use case empowers financial institutions and fintech platforms to verify gig workers income in a fast, accurate, and user-consented way—driving inclusion while maintaining compliance.

Key Features

- Multi-Source Aggregation

Collect income data across platforms like Uber, Upwork, Fiverr, or DoorDash with the users consent.

- Real-Time Data Syncing

Fetch updated income records using secure APIs to provide the latest earning history.

- Income Pattern Analysis

Understand weekly/monthly trends, frequency of jobs, and payment consistency to make better risk decisions.

- PDF or Digital Proof Generation

Generate downloadable, verified income reports that users can attach to applications (e.g., rental, credit, or government aid).

Ideal Use Scenarios

Loan and credit applications for gig workers

Renting or leasing services needing income proof

Buy Now Pay Later (BNPL) platforms

Personal finance apps that offer tax and budgeting tools

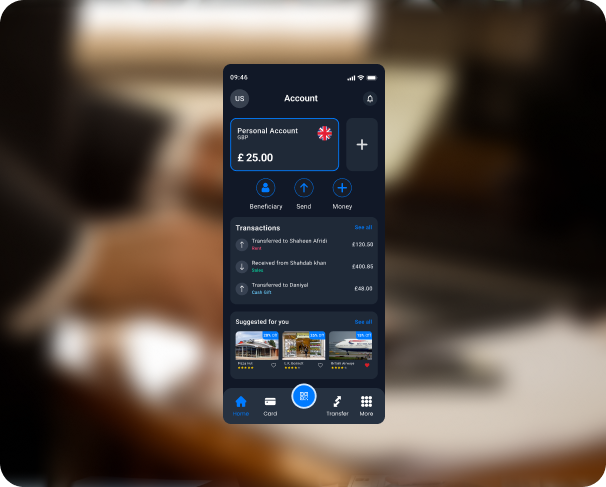

Neobanks or challenger banks onboarding self-employed users

Income Verification for Gig Economy Workers

Real-Time Income Data from Multiple Platforms

Reduce Risk in Lending & Credit Decisions

Self-Employed Friendly Verification Flow

Business Impact

- Reduce Manual Documentation Time

Eliminate the back-and-forth of requesting screenshots or paper payslips.

- Stay Compliant with Affordability Checks

Meet local lending regulations by proving affordability with up-to-date digital income data.

- Offer Personalised Financial Products

Use insights from income patterns to build custom offers, like credit limits or savings suggestions.

Which of My Services This Belongs To:

- ●KYC / KYB Verification Services

- ●Open Banking Integrations

- ●Income Insights & Analytics

- ●Lending & Credit Risk Scoring Modules